Is There A Penalty For Not Having Health Insurance In New Jersey

Some states have an individual health insurance mandate in place so depending on where you live you may be required by law to have qualifying health insurance coverage and could face a penalty if you are uninsured for three months or longer. You may either be charged a flat amount of 695 for each adult or 34750 for each child without insurance or you may be charged 25 of your gross income that is in excess of the filing threshold in the state.

District of Columbia Washington DC No matter which state you live in eHealth can help make sure you have the health insurance coverage that you need.

Is there a penalty for not having health insurance in new jersey. But unless you qualify for an exemption there is a penalty for being without minimum essential coverage if you live in California Rhode Island Massachusetts New Jersey. The minimum tax penalty in NJ is 695 and the maximum is 3012 for 2019. Obamacares tax penalty went away in 2019That means that if you didnt have health insurance coverage in 2019 you wont have to pay a penalty when you file your taxes in this year.

However New Jersey residents are not off the hook. Get the Best Quote and Save 30 Today. If you do not have health insurance and do not qualify for an exemption you may have to pay a tax penalty for each month without minimum coverage.

Read complete answer hereThen is there a penalty for not having health insurance in 2019 in New York. Failure to have health coverage or qualify for an exemption by December 15 2018 will result in a health tax SRP assessed on your 2019 New Jersey Income Tax return. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

New Jersey residents will have to pay a penalty if they go without health insurance in 2019 under a new state law that takes effect starting New Years Day. The chosen method for the penalty will be based on whichever amount is higher. The New Jersey law allows the state treasurer to enforce the law according to New Jersey tax law and conditions especially in determining exemptions from the tax penalty.

As of 2021 there are penalties for being uninsured in Massachusetts New Jersey California Rhode Island and the District of Columbia. The Affordable Care Acts individual mandate penalty was reduced to 0 as of 2019 so there is no longer a federal penalty for not having minimum essential health coverage. If you have coverage for part of the year the fee is 112 of the annual amount for each month you or your tax dependents dont have coverage.

Portra Images Digital Vision Getty Images More than a decade after it was enacted most parts of the Affordable Care Act ACA aka Obamacare are supported by the majority of Americans. But if youre in California DC Massachusetts New Jersey or Rhode Island there is a penalty for being uninsured which is assessed when you file your state. You may have to pay a penalty for not having health insurance if you live in one of the following states.

In the past they did not assess a health insurance penalty if someone paid one at the federal level. Using the per person method you pay only for people in your household who dont have insurance coverage. The New Jersey law imposing a state tax penalty for not having health insurance in 2019 is patterned on the individual mandate tax penalty in the federal Affordable Care Act.

The health insurance penalty is based on New Jerseys prices for bronze level health insurance policies. New Jersey residents are still subject to an individual mandate ans possible tax penalty in 2019 and beyond. There are consequences to not maintaining proper health coverage.

In most states the answer is no. Grab our step-by-step guide to enrolling in Marketplace coverage aka Obamacare or Affordable Care Act insurance to learn more. Get the Best Quote and Save 30 Today.

This is known as the individual mandate. This state has a health insurance penalty that went into effect in 2019. Anzeige Compare Top Expat Health Insurance In Austria.

And this means that in those places you still must have health insurance or pay a health insurance penalty on your income tax return for the tax year you did not have minimum essential coverage. For residents of most states the federal tax penalty for not having health insurance disappears at the end of 2019. If youre uncovered only 1 or 2 months you dont have to pay the fee at all.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. Secondly what happens if I dont have health insurance in 2019. Anzeige Compare Top Expat Health Insurance In Austria.

Massachusetts has had a health insurance penalty since instituting a state health insurance program in 2006. You and your tax household must have minimum essential health coverage qualify for an exemption or remit a Shared Responsibility Payment when you file your New Jersey Income Tax return. Wondering whether youll owe a tax penalty for being uninsured.

If you are not required to file a Resident New Jersey Income Tax return you are not subject to a Shared Responsibility Payment. California Massachusetts New Jersey Rhode Island Vermont and Washington DC.

Health Insurance Marketplace Calculator Kff

Stay Covered After A Move By Getting Health Care In Your New State Healthcare Gov

Sample Penalties Under Individual Madate Health Care Reform Affordable Health Insurance Health Care

Getcoverednj Getcoverednj Twitter

Health Insurance And You Health Insurance Health Insurance Companies Affordable Health Insurance

Short Term Health Insurance Availability In Your State

Pin On Please Give Me A Info About Health Insurance

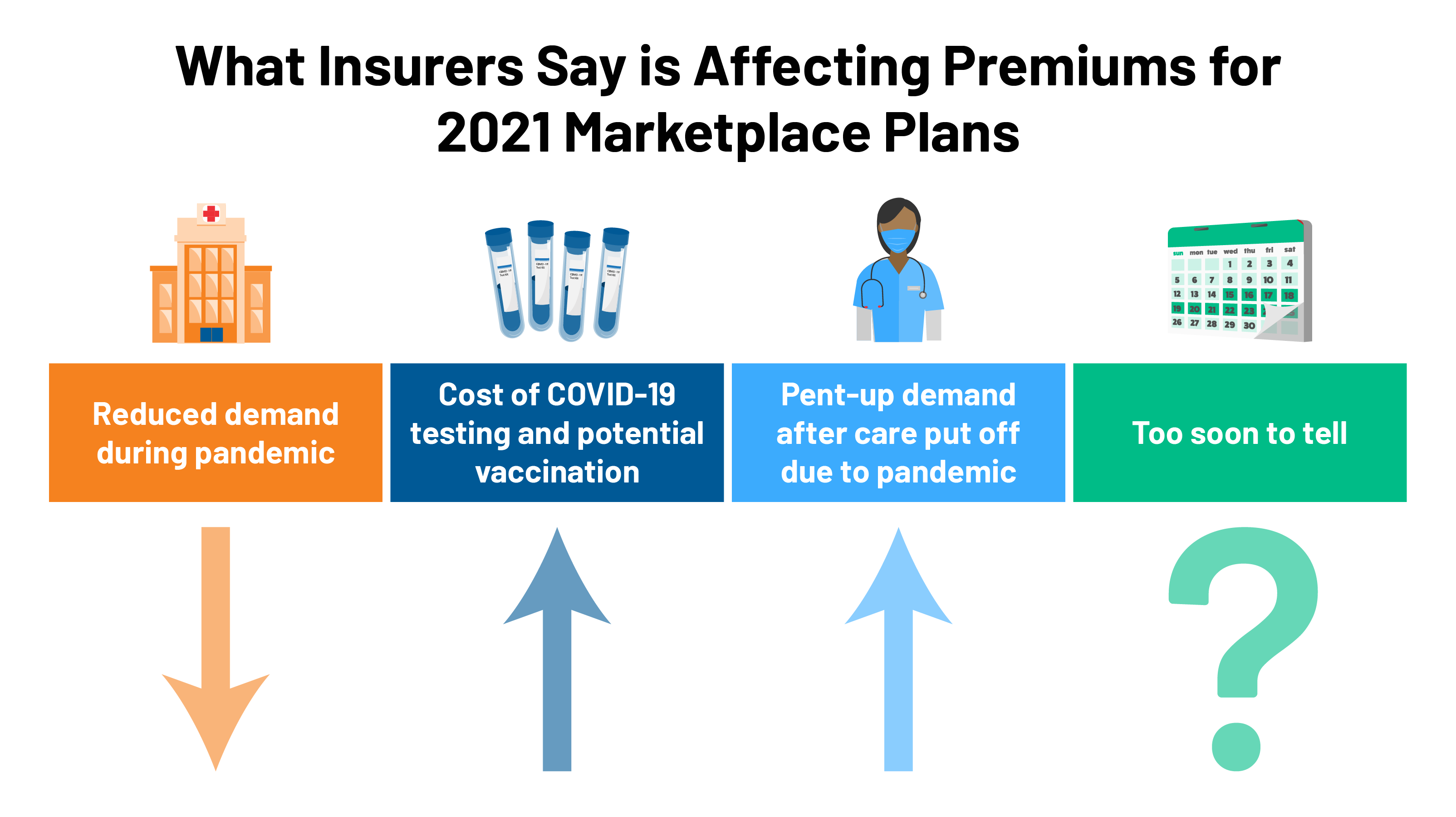

2021 Premium Changes On Aca Exchanges And The Impact Of Covid 19 On Rates Kff

New Jersey Health Plan Savings

Who Has The Cheapest Health Insurance In New Jersey Valuepenguin

New Jersey Paid Family Leave Expanded To 12 Weeks Govdocs

Will You Owe A Penalty Under Obamacare Healthinsurance Org

Open Enrollment 2022 Guide Healthinsurance Org

Health Insurance Glossary Infographic Via Topoftheline99 Com Panfleto

Post a Comment for "Is There A Penalty For Not Having Health Insurance In New Jersey"